Final yr I shared so much about my automotive mortgage debt and the way I used to be paying it off.

Now that it’s out of the way in which and paid off, I’m positively shifting my focus to assault my scholar loans this yr. I put scholar loans on the again burner final yr since my technique to repay my debt includes eliminating excessive curiosity debt first and dealing my manner right down to the decrease curiosity debt so as to lower your expenses.

In consequence, I put little or no towards my scholar loans final yr and curiosity ate up fairly a little bit of that cash.

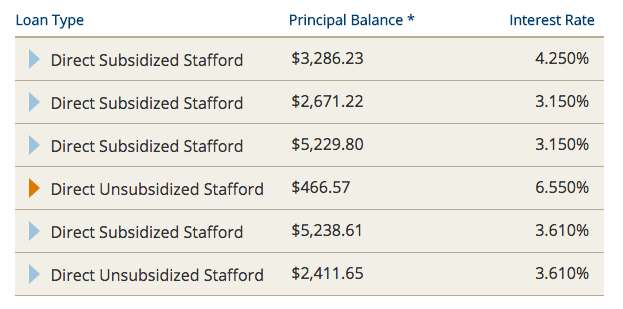

Under is a display screen shot of my present scholar mortgage balances:

I gathered loans throughout school like most different folks. I noticed nothing flawed with it on the time as a result of everybody else was taking out loans and stepping into debt as effectively. I additionally wished to stay above my means on the time and sometimes took out further loans to assist fund issues like housing, meals, leisure, and even a research overseas journey. I don’t remorse learning overseas. It was an opportunity of a lifetime; however I do nevertheless, want I’d have targeted on methods to earn more cash throughout school so I didn’t need to take out scholar loans. I did a paid internship which I liked, however I used to be all the time keen and keen to do further and keep busy. I positively might have harnessed the energy of aspect hustling to earn more cash in my spare time whereas nonetheless sustaining my lessons and grades.

As you all know, I wish to eliminate this debt ASAP so I’m looking for probably the most environment friendly solution to pay it off within the shortest period of time. That is after I thought of consolidation and refinancing my loans.

Consolidation and refinancing will not be one in the identical, however they’re very comparable. Consolidation and refinancing are greatest in case you have a big steadiness it’s essential sort out, or excessive rates of interest in your loans that may very well be decrease. For people who’re fortunate sufficient to have a small steadiness, you need to know that you should have at the least $7,500 to fulfill the eligibility necessities of most firms. The $18,000 I nonetheless have in debt is some huge cash to me.

RELATED: Is It Value It To Refinance Your Pupil Loans?

What Consolidation Entails

Consolidation includes combining a number of scholar loans into only one mortgage. By rolling all of your loans into one quantity, consolidation will simplify the debt by permitting fewer payments and funds to maintain monitor of every month.

As well as, consolidation permits debtors to modify out older, variable price loans with only one rate of interest whereas probably decreasing your month-to-month cost as effectively. Consolidation may be finished with a federal or personal lender.

How Refinancing is Totally different

Refinancing is much like consolidation in that it means that you can mix a number of loans into one quantity and decrease your rate of interest. While you use a refinance scholar loans program, you’re taking out a separate mortgage with new phrases by means of a brand new personal lender to repay your mortgage steadiness, then you definitely pay again the personal lender at a decrease rate of interest.

Which Choice is Finest for Me?

I’ve been considering so much about refinancing my loans these days. The dialog has additionally come up throughout a current recording of my new podcast Monetary Dialog (that has but to air), the place the women and I focus on our tackle scholar mortgage debt.

The advantages of each consolidation and refinancing sound good, however there are a number of disadvantages. If I selected to refinance my federal loans, I’d hand over any alternative to obtain federal mortgage aid choices like deferment, forgiveness, income-driven plan and extra ought to I ever want them.

I haven’t actually even taken benefit of any of those choices and as of now I don’t plan to sooner or later. If something ever occurred to me the place I couldn’t earn an revenue or make ends meet, it’s good to have these choices, however I’d additionally get pleasure from a decrease rate of interest and the flexibility to pay my loans off faster.

I don’t wish to drag the compensation course of alongside and I’m hoping to be scholar mortgage debt free in two years on the newest.

On the flip aspect, my rates of interest will not be that top regardless that they might be decrease. Proper now I pay one month-to-month cost for my scholar loans however the quantity is break up among the many 5 loans I’ve and I’ve no management over which mortgage I need the cost to go towards except I pay further every month. I can’t stand that.

With one cost and one decrease rate of interest, I really feel like I could make extra progress as a substitute of getting one cost being break up 5 alternative ways.

Consolidation and refinancing are greatest in case you have a big steadiness it’s essential sort out, or excessive rates of interest in your loans that may very well be decrease. The $19,000 I nonetheless have in debt is some huge cash to me.

After weighing these execs and cons, I really feel like refinancing my loans can positively assist me crush my scholar mortgage debt, if I’m keen to take the small danger of opting out of Federal scholar mortgage aid choices. I actually want I’d have refinanced my automotive mortgage final yr, however I ended up paying it off so quick. I’m positively all about paying much less on debt and minimizing the sum of money that will get wasted on curiosity.

What do you assume? Ought to I refinance or simply persist with my present scenario and throw all I can at my debt.

Leave a Reply