Beginning a enterprise is a tricky feat for almost anybody, even these washed in money. For those who comply with sports activities, you typically hear tales {of professional} athletes value thousands and thousands of {dollars} can lose all of it by making a number of dangerous enterprise choices. Or, their enterprise that appeared so promising in the beginning shuts their doorways three months later.

Having the ability to begin a enterprise with debt could appear troublesome. It’s no secret that each one companies want one factor to essentially get off the bottom: money. Companies want an injection of cash to cowl prices and develop.

For these in debt, beginning a enterprise may appear unimaginable. You may as nicely attempt to hop one-legged up Mount Everest! We’re right here to let you know that it’s not unimaginable. We will’t sugarcoat it both, however with loads of dedication and administration, you can begin a enterprise.

Under, we now have 5 recommendations on how one can go about reaching your dream of beginning your personal enterprise.

Search for Totally different Methods to Fight Your Debt

Whether or not you’re graduating faculty or are simply dealing with an enormous wall of bank card debt, it’d look like the one choices you could have are to be making these month-to-month funds on time and getting forward when you’ll be able to.

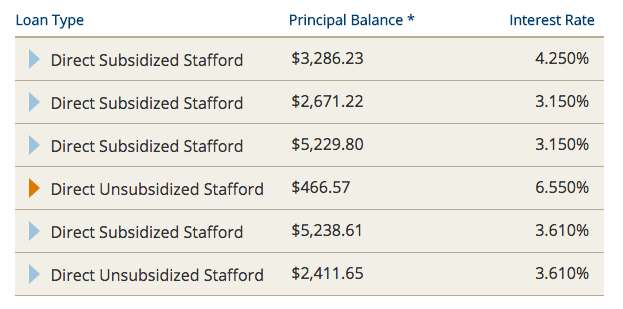

In case you’re dealing with pupil debt, strive analyzing varied compensation choices. There are many other ways to pay again these loans and most are unaware of these choices. Perform a little research in your state of affairs and see for those who qualify for any of these plans.

Right here’s a shortlist to your search efforts:

- Graduated compensation plan

- Prolonged compensation plan

- Earnings-based compensation plan

- Earnings-sensitive compensation plan

These revenue plans could also be of specific curiosity to any future entrepreneurs, as they arrange fee plans dependent in your month-to-month revenue and household dimension. In actual fact, you’ll be able to qualify for mortgage forgiveness in case your funds haven’t been accomplished after 20 years.

For these with bank card debt, take into consideration how one can consolidate that fee. That approach, it can save you on curiosity funds and management your debt with extra ease.

Associated: Saving and Paying Off Debt With an Irregular Earnings

Finest Methods and Tricks to Crush Credit score Card Debt

Reflections on Paying Off My Scholar Loans In Much less Than 3 Years

Tips on how to Keep away from Defaulting on Your Scholar Loans

Consider a Enterprise With Low Up-Entrance Prices

Though you may be doing an amazing job consolidating your debt, you continue to may be within the gap. Your dream of opening an attractive storefront might have to attend as you discover different choices.

Certainly one of these choices is the e-commerce enterprise. Massive names like Amazon have gotten increasingly more widespread yearly, however do you know that in two years time, roughly 20% of all retail purchases can be made on-line?

One of many extra cost-friendly companies to begin is dropshipping, the place your retailer acts as the center man between the gadgets and the buyer. Though you’re promoting bear traps, chances are you’ll by no means even have one in your neighborhood. Discover an amazing area, arrange a retailer, and increase, you might be off to the races!

That is simply an instance, however positively a enterprise value wanting into.

Associated: Tips on how to Make Cash with a Weblog or Area of interest Web site

High Methods to Earn Passive Earnings (And Why It’s Necessary!)

Discover Prepared Buyers

A lot simpler stated than completed, however discovering buyers who’re cash-ready is unquestionably going to assist get your corporation off the bottom.

This does include some sacrifices nonetheless, in that you’ll have to just accept a 50-50 partnership or lose the bulk management of your corporation. It additionally could also be a Shark Tank like seek for companions who’re prepared to foot the invoice. Your metropolis or city might have grants out there for those who’re beginning an area enterprise.

In case you’re having bother discovering a companion, would you ever take into account turning to a good friend or relative? It may not be one of the best concept but it surely may additionally be the one place the place it is possible for you to to get money rapidly.

Handle Your Exterior Bills

Whenever you’re getting off the bottom, there’s not going to be an entire lot extra room in your life aside from investing in your corporation and paying off any excellent debt.

That’s why it’s worthwhile to have a picture-perfect monetary plan not only for your corporation, however to your private life. Everybody’s expertise is totally different, however you may need to be budgeting right down to the greenback every month.

Go over your monetary statements and see what you’ll be able to sacrifice or reduce out. You may need to cease going to trivia each Tuesday or make extra frequent use of public transportation. It would be time to chop cable out and simply depend on streaming reveals.

Take a look at your bills and ask your self, “Do I would like this. No, do I actually want this?” Every greenback saved generally is a greenback invested again into your corporation or serving to you get out of debt.

Leave a Reply